Contents

- Preamble

- Executive Summary

- 1.0 Background

- 2.0 Canada’s Aspirational Goals for Aviation

- 3.0 Canadian Context

- 4.0 Recent Achievements

- 5.0 Measures

- 6.0 Additional Measures

- 7.0 Governance and Reporting

- Appendix A—Fuel Consumption Baseline

- Appendix B—Summary Table of Measures

- Appendix C— The Working Group’s Areas of Focus

- Appendix D—Figures and Tables

Preamble

While air travel supports Canada’s economy, trade and tourism, and connects Canadians separated by great distances and rugged terrain, it also contributes to greenhouse gas emissions. This voluntary Action Plan expresses how the parties, in good faith, intend to reduce greenhouse gas emissions from aviation activities.

It does not contain legal obligations of any kind or impose unreasonable expectations on any party, or intend to negatively impact any air carrier’s ability to do business in Canada.

The Government of Canada reserves the right to develop and implement appropriate regulatory or other measures to achieve clean air and climate change goals. Nothing in this Action Plan will keep the Parties from taking further actions relating to greenhouse gas emissions or fuel use.

Dated at Ottawa this 1st day of June 2012

Honourable Denis Lebel,

Minister of Transport, Infrastructure and Communities

Transport Canada

Jim Quick, President and CEO

Aerospace Industries Association of Canada

John McKenna, President and CEO

Air Transport Association of Canada

Daniel-Robert Gooch, President

Canadian Airports Council

Sam Barone, President and CEO

Canadian Business Aviation Association

George Petsikas, President

National Airlines Council of Canada

John W. Crichton, President and CEO

NAV CANADA

Executive Summary

Building on the success of the world’s first voluntary agreement to address greenhouse gas ( GHG ) emissions from aviation, the Government of Canada and the Canadian aviation industry have developed Canada’s Action Plan to Reduce Greenhouse Gas Emissions from Aviation (the Action Plan).

Taking into account achievements to date, as well as the Canadian context, the Action Plan sets an ambitious goal to reduce GHG emissions from both domestic and international operations, which we expect to contribute to global efforts to minimize aviation’s carbon footprint.

In line with the broad international consensus, the Action Plan sets an aspirational goal to improve fuel efficiency from a 2005 baseline by an average annual rate of at least 2 percent per year until 2020. To help ensure we reach this goal, the Action Plan identifies three key measures that are expected to have the greatest environmental impact:

- Fleet Renewals and Upgrades;

- More Efficient Air Operations; and

- Improved Capabilities in Air Traffic Management.

The Action Plan also highlights a second set of measures. The Canadian aviation industry expects these measures to have beneficial environmental results, but these results are not expressed in quantitative terms due to the nature or current stage of the activity. These include:

- Aviation Environmental Research and Development;

- Alternative Fuels;

- Airport Ground Operations and Infrastructure Use;

- Regulatory Measures; and

- International Coordination.

The Action Plan is a living document that will evolve through:

- Semi-annual meetings between government officials and the Canadian aviation industry;

- Annual reporting on the progress towards achievement of the Action Plan’s fuel efficiency target;

- A review of the Action Plan, that will occur in three years; and

- An audit that will occur at least once over the next five years.

1.0 Background

Under the Cancun Agreements, Canada has committed to a national greenhouse gas ( GHG ) reduction target of 17 percent below 2005 levels by 2020. The Government of Canada has been working towards this target by addressing GHG emissions on a sector-by-sector basis.

The aviation industry1 and the Government of Canada have been working together to reduce domestic and international GHG emissions from the aviation sector since 2005. Any future efforts to reduce domestic aviation emissions will contribute to Canada’s broader 17 percent climate change target.

In October 2010, the International Civil Aviation Organization ( ICAO ) adopted a new Assembly Resolution on climate change, Resolution A37-19. It set several voluntary goals for international aviation emissions, including:

- A global annual average fuel efficiency improvement of 2 percent until 2020;

- A medium-term aspirational goal of keeping the annual global net carbon emissions from international aviation from 2020 onward at the same (2020) level; and

- A global aspirational goal of 2 percent annual fuel efficiency improvement from 2021 to 2050.

To help ICAO track progress towards reaching these goals, the resolution encourages Member States to submit action plans detailing specific measures to address GHG emissions related to international aviation to ICAO by June 2012.

A joint government-industry Working Group on Aviation Emissions (the Working Group) was established in 2010 to develop a plan to address GHG emissions from the domestic aviation sector, as well as to collaborate on the development of the Government of Canada’s submission to ICAO . This collaboration builds on existing efforts to address GHG emissions, such as:

- The 2005 voluntary agreement signed between the Air Transport Association of Canada ( ATAC ) and Transport Canada;

- The work undertaken by the Canadian Airports Council ( CAC ) and Transport Canada to develop a quantification methodology for GHG emissions at Canadian airports; and

- The efforts of NAV CANADA to identify and quantify the results of past GHG reduction initiatives in its annual CIFER (Collaborative Initiatives for Emissions Reductions) Reports since 1997.

2.0 Canada’s Aspirational Goals for Aviation

Canada’s Action Plan to Reduce Greenhouse Gas Emissions from Aviation (the Action Plan) describes ongoing and planned activities to reduce GHG emissions from Canada’s domestic and international aviation activities. These measures could contribute to both Canada’s national GHG emission reduction target of 17 percent below 2005 by 2020 and ICAO ’s global goals.

In order to reduce GHG emissions from Canada’s aviation sector, Canada has set a target of:

- Average annual improvements in aviation fuel efficiency of at least 2 percent per year until 2020 from a 2005 baseline, measured in litres of fuel per Revenue Tonne Kilometre ( RTK ).

The 2005 baseline is consistent with Canada’s commitments under the Cancun Agreements. In 2005, the average fuel efficiency rate for Canadian air carriers was 40.46 litres of fuel per 100 RTK (see Appendix A for more details).

Through its efforts, Canada’s aviation sector supports the following global aspirational goals:

- Carbon neutral growth from 2020 onwards; and

- Absolute GHG emission reductions by 2050.

3.0 Canadian Context

Understanding the role of the aviation sector in Canada helps put the potential impact and feasibility of Canada’s target and global goals in context.

Based on land mass, Canada is the second largest country in the world. Its population of 33 million is scattered across 9 million square kilometres. This means that air transportation is essential to Canada’s domestic and international trade, as well as to connecting Canadians within the country and to the rest of the world. Canada’s air industry also serves remote communities where it is often the only way to move people and basic commodities.

Average distances flown domestically per passenger are considerably higher in Canada than in countries with smaller landmass. For example, in 2009:

- The domestic average distance per passenger flown was about 1325 kilometres in Canada,2 compared to about 425 kilometres3 in the United Kingdom; and

- The domestic average distance per tonne of cargo flown in Canada, was about 1050 kilometres,4 compared to about 385 kilometres in the United Kingdom.5

Aviation plays a key role in Canada’s economy. In 2009, the aviation sector carried over 71 million passengers and 762,000 tonnes of freight to, from and within Canada. Air transportation contributes $33 billion to Canada’s Gross Domestic Product ( GDP ) and supports 401,000 jobs in Canada (2.4 percent of the Canada’s workforce). By including the sector’s contribution to the tourism industry, these figures rise to 2.8 percent of Canadian GDP and 551,000 jobs, or 3.3 percent of the workforce.6

The 26 National Airport System ( NAS ) airports provide access to air transportation to Canadians with airport passenger volumes of up to 31 million in 2010 (see Figure 1). Airports across Canada strive to be as competitive as possible to meet the needs of local, provincial, and national economies. To do so, airports must be safe and secure, and have processes in place to efficiently move people and goods, address environmental issues, and provide excellent service.

Figure 1—National Airport System (NAS) Airports and 2010 Passenger Volumes

Source: Transport Canada, Economic Analysis.

Note: Mirabel, a NAS airport, is not included because it does not serve passengers.

4.0 Recent Achievements

4.1. Actions Taken

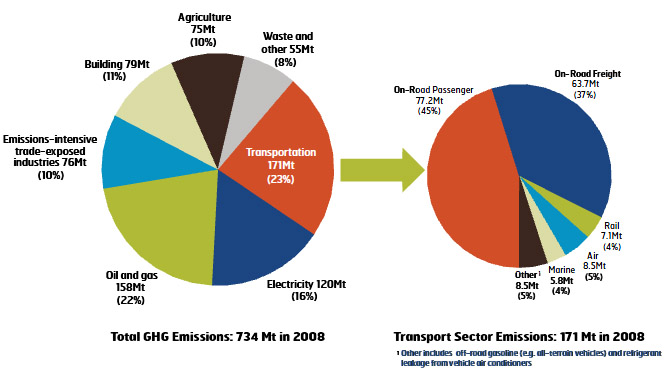

In 2008, aviation emissions made up 5 percent of domestic emissions from transportation and 1 percent of total Canadian emissions (see Figure 2).7 Despite the high and rising demand for airline services in Canada, the Canadian aviation industry has made real progress towards limiting its carbon footprint.

Figure 2—Aviation’s Contribution to Canada’s Total GHG Emissions

Source: Environment Canada, Canada’s Emissions Trends, 2011.8

HTML

| Sector | Megatonnes ( Mt ) | Percentage % |

|---|---|---|

| Building | 79 Mt | 11% |

| Agriculture | 75 Mt | 10% |

| Waste and other | 55 Mt | 8% |

| Transportation | 171 Mt | 23% |

| Electricity | 120 Mt | 16% |

| Oil and Gas | 158 Mt | 22% |

| Emissions-intensive trade-exposed industries | 76 Mt | 10% |

| Mode | Megatonnes ( Mt ) | Percentage % |

|---|---|---|

| On-Road Passenger | 77.2 Mt | 45% |

| On-Road Freight | 63.7 Mt | 37% |

| Rail | 7.1 Mt | 4% |

| Air | 8.5 Mt | 5% |

| Marine | 5.8 Mt | 4% |

| Other1 | 8.5 Mt | 5% |

1Other includes off-road gasoline (e.g. all-terrain vehicles) and refrigerant leakage from vehicle air conditioners.

In June 2005, ATAC and Transport Canada signed the world’s first voluntary agreement to address GHG emissions from both domestic and international aviation operations. The agreement set a goal of a 1.1 percent average annual improvement in fuel efficiency for each year to 2012, a cumulative improvement of 24 percent, compared to the 1990 baseline.

In 2008, the large Canadian carriers (Air Canada, Jazz Aviation LP, Air Transat, and WestJet) left ATAC and formed the National Airlines Council of Canada ( NACC ). Since then, both associations have continued to fulfill their commitments under the voluntary agreement, annually reporting fuel consumption and activity measurements.

A number of key initiatives have been put in place to:

- Increase the fuel efficiency of the Canadian aircraft fleet and its operations;

- Improve the efficiency of Canada’s air traffic management system; and

- Modernize airport facilities.

Highlights include:

- Canadian airlines invested about $13.5 billion from 2005 to 2010, to modernize their fleets, which brings newer, quieter, and more fuel-efficient aircraft into operation. For example, Air Canada, Jazz Aviation LP, and WestJet, Canada’s three largest airlines, have an average fleet age of about twelve years (see Appendix D for more details). They also adopted operational, maintenance, and planning procedures to ensure that their current aircraft operate under optimal conditions to increase fuel efficiency.

- NAV CANADA, which is the private corporation that owns and operates Canada’s civil air navigation service, has invested over $1.7 billion since 1996 to modernize Canada’s air navigation system. These investments have helped improve safety and operational efficiency for all customers, and have facilitated reductions in fuel burn and

GHG

emissions.

NAV CANADA reports on the various collaborative initiatives that support the reduced impact of aviation on the environment through the CIFER Reports.9

NAV CANADA has made significant progress towards adopting performance-based navigation ( PBN )10, using existing specifications and instrument procedure design criteria. Furthermore, NAV CANADA established a PBN Working Group with customers and stakeholders, which developed a PBN implementation framework and concept of operations for Canada. NAV CANADA has also played a key role in developing the ICAO PBN guidance material and navigation specifications.

- Canadian airports have invested more than $14 billion in capital infrastructure commitments and improvements since the devolution of airports began in 1992. These upgrades include:

- Using more renewable energy sources in their operations;

- Adding electrical and alternative fuel vehicles to their ground support equipment; and

- Installing equipment at gates to reduce the use of aircraft auxiliary power units ( APU s).

Together, these investments have greatly contributed to modernizing Canada’s airline, airport, and air traffic management infrastructure, which was ranked first according to the World Economic Forum in 2011.11

4.2 Results

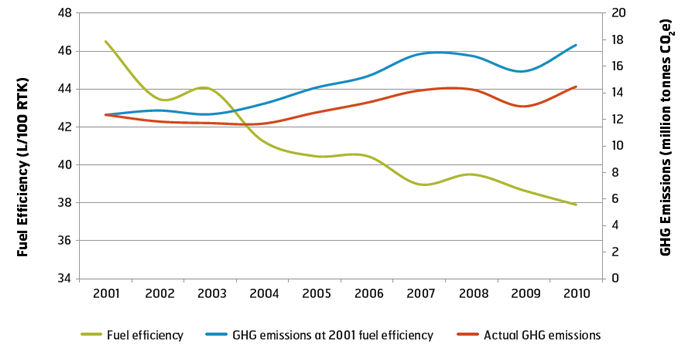

As of 2010, Canada’s aviation industry had made a 1.9 percent average annual fuel efficiency improvement since 1990, or a 31 percent cumulative improvement, which exceeds the agreed-upon goal in the voluntary agreement. While absolute domestic and international emissions have grown at an average annual rate of 1 percent between 1990 and 2010, this rate would have been much higher without these fuel efficiency improvements (see Figure 3). One estimate suggests that the fuel efficiency gains achieved between 2001 and 2010 from fleet renewal, operational, and air traffic management improvements have reduced emissions by 18 million tonnes below what they would have been without such measures.12

Figure 3—GHG Emissions Saved With Fuel Efficiency Gains between 2001 and 2010

Source: 2010 Canadian Aviation Industry Report on Greenhouse Gas Emissions reductions, March 2012.

HTML

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Fuel Efficiency in Litres/100 RTK | 46.51 | 43.50 | 44.01 | 41.28 | 40.46 | 40.47 | 38.98 | 39.49 | 38.65 | 37.90 |

| GHG Emissions at 2001 Efficiency | 12.35 | 12.67 | 12.39 | 13.15 | 14.36 | 15.24 | 16.91 | 16.79 | 15.62 | 17.61 |

| Actual GHG | 12.35 | 11.85 | 11.72 | 11.67 | 12.49 | 13.26 | 14.17 | 14.25 | 12.98 | 14.47 |

4.3 Moving Forward

To build on the aviation sector’s fuel efficiency advances thus far, the Canadian aviation industry, together with the Government of Canada, must address a number of challenges and explore new opportunities. This is why Canada’s Action Plan takes a sustainable development approach by taking into account the economic, social and environmental impacts of each measure.

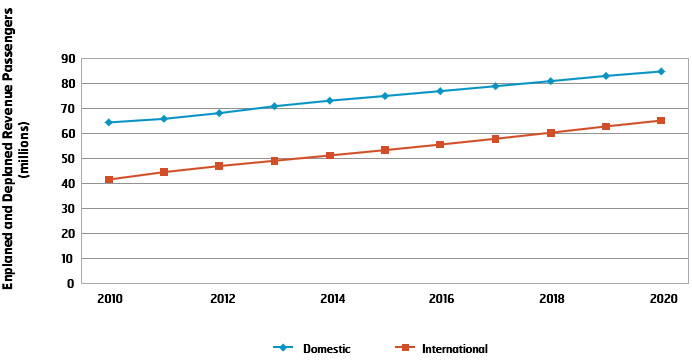

Transport Canada forecasts that domestic air traffic will grow at an average annual rate of 2.8 percent until 2020, while international air traffic will grow at a rate of 4.4 percent (see Figure 4). Transport Canada’s forecast is largely in line with the air traffic forecasts produced by the aviation industry.13

Figure 4—Forecasted Growth of Passenger Traffic by Sector

Source: Transport Canada, Economic Analysis.

HTML

| Domestic | International | |

|---|---|---|

| 2010 | 64 | 41 |

| 2011 | 66 | 44 |

| 2012 | 68 | 47 |

| 2013 | 71 | 49 |

| 2014 | 73 | 51 |

| 2015 | 75 | 53 |

| 2016 | 77 | 55 |

| 2017 | 79 | 58 |

| 2018 | 81 | 60 |

| 2019 | 83 | 63 |

| 2020 | 85 | 64 |

The accuracy of all traffic forecasts depend on a number of variables, including economic conditions. Transport Canada’s forecast was produced in June 2011 and does not reflect the recent economic turmoil in international financial markets.

In response to changing markets, Canadian airlines continually modernize their fleets and adjust fleet use. NACC airlines plan to invest over $13.7 billion more between 2011 and 2020. When compared to earlier investments in fleet modernization from 2001 to 2010, the resulting fuel efficiency gains will be relatively small because the next significant gains will likely occur after 2020, through new aircraft designs, new engines, etc.

The fleet renewal efficiency gains are dependent on two assumptions:

- New aircraft will be delivered on schedule. One major air carrier’s aircraft acquisition program, for example, is currently four years behind schedule due to manufacturing issues. Delays will impact anticipated fuel efficiency improvements; and

- All replaced aircraft will be retired from service. However, if these aircraft remain in or return to service, this could impact fuel efficiency improvements. Older aircraft may be brought back into service to provide additional capacity to meet market demand.

Canada’s air traffic management system and airport facilities have also been greatly improved over the past two decades. So, while real environmental benefits have been realized, the expected growth in air traffic will require the Canadian aviation industry to continue to make further advances.

Moving forward, the development of sustainable alternative aviation fuels will be a key initiative required by the aviation industry to meet the global aspirational goal of carbon neutral growth from 2020. Substantial advances in developing and commercializing sustainable alternative aviation fuels will be needed in light of the key issues related to limited fuel options and availability of supply for aviation.

In 2006, the Government of Canada developed a comprehensive renewable fuels strategy primarily focussed on on-road transportation with four key elements:

- A regulation to establish minimum biofuels content for gasoline and diesel;

- Programs to support farmer participation in the industry;

- A production incentive to stimulate domestic production; and

- Initiatives to support next generation technologies.

The Government of Canada will continue to assess the progress of the renewable fuels strategy and analyze areas for future policy development.

Canada recognizes the interdependencies of the environmental effects from aviation, such as noise and engine emissions, which affect the global climate and local air quality. Canada also recognizes that there will be tradeoffs among environmental objectives, such as between noise and emission reductions. These interdependencies will be considered when establishing policies and measures to minimize or reduce these effects, recognizing that the interdependencies could limit the full potential of the environmental benefit of the proposed measures.

5.0 Measures

The measures detailed below will help Canada achieve the fuel efficiency target over the next five years (see Appendices B and C for more details). These measures are listed separately from those in the next section (Section 6) because they represent the greatest opportunities to improve fuel efficiency and reduce GHGs .

5.1 Fleet Renewals and Upgrades

- Canadian airlines expect to achieve an average annual fuel efficiency improvement of 0.7 percent for both domestic and international flights between 2005 and 2020 through further fleet changes.14

- The Canadian Business Aviation Association ( CBAA ) will encourage its members to take advantage of opportunities to reduce GHG emissions through fleet renewal.

5.2 More Efficient Air Operations

- Canadian airlines expect to achieve an average annual fuel efficiency improvement of 0.2 percent for both domestic and international flights between 2005 and 2020 through improved operations.15

- CBAA will encourage its members to continue to adopt operational improvements to reduce emissions.

- Transport Canada will continue to work through ICAO to help prepare and provide guidance, and to encourage technology and operational improvements. This includes updating ICAO Circular 303 Operational Opportunities to Minimize Fuel Use and Reduce Emissions, which was published in 2003, into a new ICAO manual, expected to be completed in 2012.

- NACC , ATAC , and CBAA will encourage their members to continue to take advantage of the opportunities presented in the new ICAO manual.

5.3 Improved Capabilities in Air Traffic Management

- Performance-based Navigation (

PBN

) —Shifting from sensor-based to performance-based navigation will enable more efficient en route and airport operations for equipped aircraft, reducing fuel burned and associated

GHG

emissions.

Building on existing PBN activities, further implementation could improve average annual fuel efficiency by 1 to 2 percent between 2005 and 2020. The benefits resulting from PBN will be dependent upon the following:

- Approval by Transport Canada for use of the United States Federal Aviation Authority ( FAA ) Order 8260.54A and 8260.52 instrument procedure design criteria;

- Development and approval of guidance by Transport Canada for Operations Specifications in support of the use of FAA Order 8260.52 criteria;

- Acceptance of new ICAO PBN Navigation Specifications; and

- Timely identification and incorporation of necessary regulatory changes to support

PBN

.

- Transport Canada will develop a PBN policy framework by spring 2012. It will set out the scope, opportunities, and guiding principles for adopting PBN in Canada.

- Transport Canada will continue to move short- and medium-term solutions forward to advance

PBN

in Canada. These measures include:

- Incorporating new PBN -based Canadian air navigation procedures, aligned with those of the United States FAA ; and

- Continuing to work with ICAO to develop and incorporate new international procedures for Canada’s air navigation system.

- The Canadian Aviation Regulation Advisory Council (

CARAC

)

PBN

Working Group, which includes representatives from Transport Canada, NAV CANADA, and the Canadian aviation industry, will identify, within the next two years, the regulatory requirements and any other non-regulatory mechanisms to help determine short-, medium-, and long-term opportunities for adopting

PBN

. The work of the

PBN

Working Group began in fall 2011.

- Surveillance—NAV CANADA has and will continue to use technologies that increase surveillance capability and coverage to maximize benefits and minimize costs. Increased surveillance capability, both airborne and on the ground, will result in more efficient air operations. Benefits include:

- Increased airspace capacity;

- Faster response times to pilot requests;

- More flexible routing; and

- Fewer ground delays.

NAV CANADA will also continue to use existing mechanisms to engage customers and stakeholders who may be affected by any changes to the Air Navigation System.

6.0 Additional Measures

Appendices Band C for more details), whose expected results are not expressed in quantitative terms due to the nature of the activity or their current stage of implementation. These measures will be essential to achieving the long-term aspirational goals.

6.1 Aviation Environmental Research and Development

Significant research efforts are underway to minimize or reduce aviation’s environmental impacts and to inform the development of future regulations. This research provides valuable information to the Government of Canada, ICAO , other governments, industry and communities on how to best address these environmental impacts. Research findings will be shared with interested parties, including Working Group members. The research is being directed in a number of key areas, including:

- Green Aviation Research & Development Network (

GARDN

)—With an initial budget of $24 million over four years (2009–13), this Canadian business-led Network of Centres of Excellence continues to undertake research and development of technologies that will help reduce GHG emissions.

GARDN

presently administers 15 projects involving nearly 30 partners, half from industry and half from academia and research centres. These projects are guided by the following research themes:

- Source Noise Reductions;

- Source Emission Reductions;

- Materials and Manufacturing Processes;

- Airport Operations;

- Aircraft Operations;

- Alternative Fuels; and

- Product Lifecycle Measurement.

- Partnership for AiR Transportation Noise and Emissions Reduction (

PARTNER

)—This is a U.S. Federal Aviation Authority Center of Excellence, sponsored by the

FAA

, NASA, Transport Canada, the U.S. Department of Defense, and the U.S. Environmental Protection Agency.

PARTNER

research fosters advances in science and decision-making to improve mobility, the economy, and the environment. Canada is committed to continue its support of

PARTNER

. Since 2003,

PARTNER

has dedicated US$44 million to research in areas such as:

- Emissions;

- Operations;

- Alternative Fuels;

- Tools, System-level, and Policy Assessment; and

- Noise.

- Canada’s National Research Council (

NRC

)—The

NRC

will continue to work on a number of projects that provide scientific support to inform regulatory decisions in Canada. These projects include:

- Developing methodologies to sample and measure aircraft particulate matter emissions; and

- In-flight sampling of aircraft engine emissions using innovative Canadian technology to study, among other things, climate change impacts from standard and alternative aviation fuels.

- The United States Transportation Research Board's Airport Cooperative Research Program ( ACRP ) —The ACRP is an industry-driven, applied research program that develops near-term, practical solutions to problems faced by airport operators. The environment is a key theme of ACRP ’s research and reports relating to aircraft noise, emissions, airport operations, air and water quality impacts and metrics. Transport Canada will continue to support and participate in ACRP in a number of key research areas.

In addition to these research initiatives, the Aerospace Industries Association of Canada ( AIAC ) will encourage its members to engage in research and development, as well as to produce new and innovative technologies on aircraft and aircraft engines as soon as it is safe, legal and practical, with a view to improve fuel efficiency and reduce GHG emissions.

6.2 Alternative Fuels

- Research, Development, and Demonstration—The Government of Canada will continue to support research, development and demonstration of alternative fuels for aviation. This includes ongoing federal research efforts under the Program of Energy Research and Development and research and development opportunities in alternative aviation biofuels under the research and development component of the ecoENERGY Innovation Initiative. In addition, Sustainable Development Technology Canada16 administers two funding programs:

- The $550 million SD Tech Fund™17, which has allocated more than $10 million to two alternative aviation fuel projects; and

- The $500 million NextGen Biofuels Fund™, which could support the commercial scale demonstration of the production of next-generation renewable fuels for aviation.

- Canada will also pursue opportunities to collaborate with its key trading partners, particularly the United States, on alternative aviation fuel research and development and certification, and explore issues such as commercial production. For example, the ongoing Canada-United States Clean Energy Dialogue includes next generation biofuels as a priority research and development area.

- The Government of Canada and the aviation industry will work collaboratively to discuss the potential for, benefits of, and barriers to alternative aviation fuel production and use in Canada.

6.3 Airport Ground Operations and Infrastructure Use

- Reducing

GHG

Emissions at the Gate and on the Ground—Airlines and airports are working together to reduce emissions from

APU

s and ground support equipment (such as baggage tugs and tractors). For example, Canadian airports are pursuing opportunities to supply their loading gates with preconditioned air, which helps to minimize the use of

APU

s. Airlines and Airport Authorities will also collaborate to develop an effective way to track how these efforts reduce emissions from these sources.

- Taxi Operations—The Canadian aviation industry (airports, airlines, and NAV CANADA) will continue to work together to reduce

GHG

emissions by reducing airport aircraft ground emissions through improved taxi and queuing procedures. They will also work to reduce taxi times associated with de-icing procedures.

The CAC , NACC and NAV CANADA will establish an average baseline for taxi times at the four major airports (Vancouver, Calgary, Toronto, and Montreal). Taxi times will then be monitored using such tools as the NAV CANADA Airport Performance Monitor ( APM )18 and airline taxi data to determine where and when significant delays occur. Delays could be due to weather, schedule conflicts, runway/taxiway infrastructure, and/or operational restrictions. This information will be assessed to identify where improved procedures and/or infrastructure could reduce taxi times and queuing.

- Airport GHG Emission Inventories—Over the past 40 years, airport ambient air quality studies have provided real-time information on airport air quality and helped to minimize aviation emission impacts at Canadian airports. Building on the success of this work, the CAC and Transport Canada completed GHG emission inventories for 26 of the NAS airports, as well as all Transport Canada-owned airports. The Airport GHG Emission Inventories quantify airport-related emissions from various activities. The CAC and Transport Canada will continue to refine and improve data quality and explore opportunities to adopt emission reductions strategies.

6.4 Regulatory Measures

- CO2 Emissions Standard—Transport Canada will continue to participate in the development of a CO2 standard for airplanes, through

ICAO

’s Committee on Aviation Environmental Protection (CAEP). This standard is targeted for completion within the next two years. Once completed and adopted by

ICAO

, Transport Canada will adopt the standard domestically under the Aeronautics Act.

- Non-volatile Particulate Matter Standard—In addition to human health concerns, there are concerns about the impact that aircraft non-volatile particulate matter (

nvPM

) may have on the global climate. Transport Canada will continue to help develop a new

nvPM

standard for aircraft engines, through CAEP, targeted for 2016.

The National Research Council, supported by Transport Canada, is participating in the development of a sampling and measurement methodology and an Aerospace Recommended Practice document for the certification requirement for the new ICAO nvPM standard for aircraft engines.

6.5 International Coordination

- Recognizing that efforts to address climate change require international action and coordination, Transport Canada will continue to actively participate, through ICAO, on the implementation of global approaches and standards to address climate change, including system efficiencies and market-based measures. Transport Canada will continue to engage the Canadian aviation industry as part of the international dialogue on these issues.

- As the Canadian member of the International Coordinating Council of Aerospace Industries Associations (ICCAIA), AIAC will strive to lead Canadian aerospace manufacturers in working directly with its international counterparts and through the ICAO CAEP process in developing and producing aircraft and engines that will meet or exceed ICAO required improvements to aircraft and aircraft engine fuel efficiency and GHG emission requirements.

7.0 Governance and Reporting

7.1 Governance

The Working Group on Aviation Emissions19 will oversee Canada’s Action Plan. Its members are representatives from:

- Transport Canada;

- Air Transport Association of Canada ( ATAC );

- National Airlines Council of Canada ( NACC );

- Canadian Airports Council ( CAC );

- Aerospace Industries Association of Canada ( AIAC );

- Canadian Business Aviation Association ( CBAA ); and,

- NAV CANADA.

The Working Group will meet at least twice a year, to monitor individual and collective progress made towards achieving Canada’s fuel efficiency target.

7.2 Annual Reporting

An Annual Report will summarize the progress that has been made in meeting GHG emission reduction goals and other Action Plan activities. The first Annual Report will be published by December 31, 2013 on the Transport Canada website.

The Annual Reports will include:

- A quantitative description of achievements (including relevant indicators such as litres of fuel consumed per type of fuel, and Revenue Tonne Kilometres). NACC and ATAC will collect all of the information necessary to report on the fuel efficiency improvements achieved;

- A list of member companies reporting; and

- A quantitative and/or qualitative description of the actions taken by all Working Group members to achieve progress on the measures identified in sections five and six of the Action Plan.

For the first two years, the aviation activity and emission data reported in the Annual Reports will be aggregated for domestic and international aviation. Beginning with the 2014 Annual Report, domestic and international aviation activity and emission data will be reported separately.

Subject to applicable laws of Canada, Working Group members agree that any and all company-specific information shall be treated as commercially confidential and will not be released to the public domain without the consent of the relevant company.

7.3 Review

The Working Group will conduct a review of the Action Plan in three years to assess progress towards the environmental goals and commitments, and update the Action Plan.

7.4 Audit

To ensure continued confidence in the reliability of the reports, a qualified auditor, chosen by the Working Group, will be given access at least once over the next five years of the Action Plan, to audit the reports, processes, and supporting documentation that pertain to the Action Plan.

Appendix A – Fuel Consumption Baseline

The 2005 fuel consumption baseline is referenced from data reported annually by ATAC and NACC in the Canadian Aviation Industry Report on Greenhouse Gas Emissions Reductions.

| 1990 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Fuel use (million litres) | 4,616 | 4,829 | 4,634 | 4,584 | 4,566 | 4,887 | 5,186 | 5,543 | 5,575 | 5,077 | 5,659 |

| GHG emissions (millions of tonnes of CO2-equivalent) | 11.801 | 12.346 | 11.846 | 11.719 | 11.673 | 12.495 | 13.258 | 14.171 | 14.254 | 12.980 | 14.467 |

| Traffic (billions) | |||||||||||

| Available seat-kilometres ( ASK ) | 75.22 | 109.58 | 117.71 | 120.01 | 123.14 | 131.98 | 139.48 | 151.55 | 154.05 | 152.66 | 156.81 |

| Revenue passenger-kilometres ( RPK ) | 66.37 | 86.68 | 89.08 | 89.24 | 95.18 | 105.22 | 112.98 | 124.15 | 125.55 | 117.62 | 128.77 |

| Passenger revenue-tonne-kilometres (pass. RTK ) * | 6.64 | 8.67 | 8.91 | 8.92 | 9.52 | 10.52 | 11.30 | 12.42 | 12.55 | 11.76 | 12.88 |

| Cargo available tonne-kilometres (cargo ATK ) | 11.12 | 13.63 | 13.37 | 11.85 | 12.21 | 13.22 | 13.54 | 14.45 | 14.12 | 14.11 | 15.26 |

| Cargo revenue-tonne-kilometres (cargo RTK ) | 1.72 | 1.71 | 1.74 | 1.49 | 1.54 | 1.56 | 1.52 | 1.81 | 1.56 | 1.37 | 1.93 |

| Total available tonne-kilometres (Total ATK ) | 18.65 | 24.59 | 25.14 | 23.85 | 24.52 | 26.41 | 27.48 | 29.61 | 29.52 | 29.38 | 30.94 |

| Total revenue-tonne-kilometres (Total RTK ) | 8.36 | 10.38 | 10.65 | 10.42 | 11.06 | 12.08 | 12.81 | 14.22 | 14.12 | 13.14 | 14.81 |

| Fuel consumption rates | |||||||||||

| Litres/ ASK | 0.0614 | 0.0441 | 0.0394 | 0.0382 | 0.0371 | 0.0370 | 0.0372 | 0.0366 | 0.0362 | 0.0333 | 0.0348 |

| Litres/ RPK | 0.0695 | 0.0557 | 0.0520 | 0.0514 | 0.0480 | 0.0464 | 0.0459 | 0.0446 | 0.0444 | 0.0432 | 0.0425 |

| Litres/Total ATK | 0.2475 | 0.1964 | 0.1843 | 0.1922 | 0.1862 | 0.1850 | 0.1887 | 0.1872 | 0.1889 | 0.1735 | 0.1824 |

| Litres/Total RTK | 0.5523 | 0.4651 | 0.4350 | 0.4401 | 0.4128 | 0.4046 | 0.4047 | 0.3898 | 0.3949 | 0.3865 | 0.3790 |

| Emission rates | |||||||||||

| CO2e grams/ ASK | 156.89 | 112.67 | 100.64 | 97.65 | 94.79 | 94.68 | 95.05 | 93.51 | 92.53 | 85.02 | 89.00 |

| CO2e grams/ RPK | 177.81 | 142.43 | 132.98 | 131.32 | 122.64 | 118.75 | 117.35 | 114.14 | 113.53 | 110.36 | 108.65 |

| CO2e grams/Total ATK | 633 | 502 | 471 | 491 | 476 | 473 | 482 | 479 | 483 | 442 | 466 |

| CO2e grams/Total RTK | 1,412 | 1,189 | 1,112 | 1,125 | 1,055 | 1,034 | 1,035 | 996 | 1,010 | 988 | 969 |

Source: 2010 Canadian Aviation Industry Report on Greenhouse Gas Emissions Reductions, March 2012, p.10.

* Note that Passenger

RTK

are calculated by dividing

RPK

by 100 kg, which is the industry’s conventional assumption of the average weight per passenger, including luggage.

Appendix B—Summary Table of Measures

| Measure | Description | Start Date | Date of Full Implementation | GHG / Fuel Efficiency Impact | Economic Cost (CDN$) | List of Stakeholders |

|---|---|---|---|---|---|---|

| Fleet Renewals and Upgrades | Retire older airplanes and bring newer, more efficient airplanes into service. | Ongoing | Ongoing | Average annual 0.7% fuel efficiency improvement from 2005 to 2020 | $13.7 billion from 2011 to 2020. | Canadian airlines, CBAA |

| More Efficient Air Operations | Canadian airlines to improve fuel efficiency through more efficient air operations. | Ongoing | Ongoing | Average annual 0.2% fuel efficiency improvement from 2005 to 2020 | To Be Determined | Canadian airlines, CBAA |

| Guidance on Operational Opportunities— New ICAO Manual | Transport Canada to continue to work through ICAO to encourage technology and operational improvements. | Update expected in 2012 | Ongoing | N/A | N/A | Transport Canada, ICAO , Aviation industry stakeholders |

| Performance Based Navigation | Shift from sensor-based to performance-based navigation. | Ongoing | Ongoing | Average annual 1 to 2% fuel efficiency improvement from 2005 to 2020 | To Be Determined | NAV CANADA, Transport Canada, Aviation industry stakeholders |

| Aviation Environmental Research and Development | Active engagement and support of aviation-related research initiatives, including: GARDN , PARTNER , the NRC , and the U.S. ACRP . | Ongoing | Ongoing | N/A | To Be Determined | Transport Canada, Industry Canada, Aviation industry stakeholders |

| Alternative Fuels | The Government of Canada to continue to support research in the development and demonstration of alternative fuels for aviation. | Ongoing | Ongoing | To Be Determined | To Be Determined | Government of Canada, Aviation industry stakeholders, U.S. partners |

| Alternative Fuels | The Government of Canada and aviation industry to discuss the potential for, benefits of, and barriers to alternative aviation fuel production and use in Canada. | Ongoing | Ongoing | To Be Determined | To Be Determined | Government of Canada, Aviation industry, other stakeholders |

| Reducing GHG Emissions at the Gate and on the Ground | Reduce emissions from using APU s and ground support equipment. | Ongoing | Ongoing | To Be Determined | To Be Determined | CAC , Canadian airlines, CBAA |

| Taxi Operations | Reduce taxi times, thereby improving fuel efficiency. | Ongoing | Ongoing | To Be Determined | To Be Determined | NAV CANADA, CAC , Canadian airlines, CBAA |

| Airport GHG Emission Inventories | Use existing GHG inventories for airports to adopt GHG reducing measures. | Ongoing | Ongoing | N/A | N/A | Transport Canada, CAC , Canadian airlines, CBAA |

| CO2 Standard for Airplanes | Through ICAO , develop a new CO2 standard for new airplanes and adopt the new standard domestically. | Standard for new airplanes targeted for completion within two years | Domestic regulatory implementation within two years of ICAO adopting the new standard | To Be Determined | To Be Determined | Transport Canada, Aviation industry stakeholders |

| Non-volatile Particulate Matter Standard | Develop the certification requirement for a new non-volatile particulate matter standard for aircraft engines. | Standard expected by 2016 | Domestic regulatory implementation within two years of ICAO adopting the new standard | N/A | To Be Determined | Transport Canada, Aviation industry stakeholders |

| International Coordination | Active participation through ICAO on implementing global approaches and standards to address the impact to the global climate. | Ongoing | Ongoing | N/A | To Be Determined | Transport Canada, Aviation industry stakeholders |

Appendix C—The Working Group’s Areas of Focus

The Working Group identified areas of focus where industry cooperation and synergies can help achieve future emission reductions. To help explore these areas of focus, subgroups were established to identify and advance emission reduction opportunities in the following areas:

- Performance-based Navigation;

- Surveillance;

- Auxiliary Power Units and Ground Support Equipment;

- Taxiing; and

- Alternative Fuels.

Performance-Based Navigation

Description:

Performance-based Navigation ( PBN ) will provide benefits to equipped aircraft operators by allowing more efficient and flexible en route and terminal (airport) operations than existing ground-based navigation. PBN includes both Area Navigation ( RNAV ) and Required Navigation Performance ( RNP ).

The PBN concept represents a shift from sensor-based to performance-based navigation. Performance requirements are identified in navigation specifications, which also identify the choice of navigation sensors and equipment that may be used to meet the performance requirements. These navigation specifications are defined at a sufficient level of detail to facilitate global harmonization by providing specific implementation guidance for States and operators. The PBN concept specifies that aircraft RNAV system performance requirements be defined in terms of the accuracy, integrity, availability, continuity and functionality, which are needed for the proposed operations in the context of a particular airspace concept.

Partners:

- NAV CANADA (Air Navigation Service Provider); Transport Canada; Aircraft Operators; and Airports.

Strategic Goals:

- Improved Air Navigation Services ( ANS ) and air operator efficiency.

Considerations:

- Transport Canada is committed to working with NAV CANADA and industry stakeholders to develop its State

PBN

plan, in accordance with

ICAO

resolution A36-23.

- Work is underway to review where amendments to the Canadian Aviation Regulations may be required to reflect the PBN concept and to include the PBN design specifications. Interim measures, such as Exemptions to the Regulations, Operations Specifications and Aeronautical Information Circulars (AICs) are providing opportunities for NAV CANADA and Canadian air operators to use PBN .

Timelines:

- Short-Term (2010–15)—Short-term implementation objectives are based on projects that have begun or are identified in NAV CANADA’s business plans as well as those that use PBN specifications that currently exist and are approved in Canada.

- Medium-Term (2015–20)—Transition from a sensor-based environment to a PBN environment will begin as PBN specifications are approved for use in Canada. Implementation will be subject to a positive business case and customer consultation.

- Long-Term (2020 and beyond)—NAV CANADA will transition to primarily a PBN environment with ground based navigation aids available only as a back-up capability. The 4D RNP operations are expected to be available to support a full gate-to-gate flight management environment.

Targets and Performance Measurement:

- To implement PBN , NAV CANADA will transition on a schedule dictated mostly by customer needs, levels of equipage, and positive business cases.

Initiative Management:

- NAV CANADA

Reporting Schedule:

- Annually in the CIFER report.

Surveillance

Description:

Increased airborne and surface (airport) surveillance capability will make ground and air operations more efficient. This means increased airspace capacity, faster response times to pilot requests, more flexible routing and less ground delays.

There are various technologies that can increase surveillance capability and coverage in what is today’s procedural airspace. NAV CANADA will use a mix of surveillance technologies to maximize benefits and minimize costs, using a business case process.

Partners:

- NAV CANADA (Air Navigation Service Provider); Department of National Defence (DND); Aircraft Operators; and Airports.

Strategic Goals:

- Improved Air Navigation Services ( ANS ), airport, and air operator efficiency

Milestones:

- ADS-B Surveillance

- Hudson Bay implemented (2009);

- ADS-B North East Coast (Labrador and Baffin Island) implemented (2011);

- ADS-B Oceanic (Greenland) in 2012;

- Other locations (To Be Determined).

- Wide Area Multilateration (WAM)

- Implemented at Fort St. John and Vancouver Harbour, BC;

- Implementation in the Kelowna area planned for 2012;

- Other sites under review.

- Multilateration—Surface Detection

- Project initiated at Pierre Elliott Trudeau Airport in Montréal;

- Planned for Calgary and Toronto international airports;

- Other airports are being assessed and will be subject to Airport Authority approval/funding.

- North Warning System—Radar Integration

- Eastern portion completed in November 2010;

- Western portion under review.

- Video Surveillance

- Under test and evaluation at various sites, including London, Ottawa, and Montréal;

- Other sites being assessed for application.

Targets and Performance Measurement:

- To be determined from individual business cases.

Initiative Management:

- NAV CANADA

Reporting Schedule:

- Annually in the CIFER report.

Auxiliary Power Units and Ground Support Equipment

Description:

Airlines and airports have been working closely together to identify ways to reduce emissions from the use of auxiliary power units ( APU s) and ground support equipment ( GSE ).

Emissions from an aircraft’s APU s can be greatly reduced if ground-based alternatives are available and used. GSE is either owned directly by airlines or contracted by airlines from third-party providers and is a major part of airport ground operations. Airlines and airports are:

- Working to improve technology;

- Adding fixed gate infrastructure;

- Developing and adopting operating procedures to more effectively use the infrastructure; and

- Using alternative fuels to improve efficiency and reduce greenhouse gas ( GHG ) emissions and criteria air contaminants.

These emission reduction opportunities support the Action Plan’s targets. The range of potential GHG reductions from these opportunities will be quantified as appropriate and feasible. The Working Group understands that these targets are intensity-based and will take into account an increase in flight schedules and equipment inventory.

Partners:

- Canadian Airports Council; Air Transport Association of Canada; National Airlines Council of Canada; Canadian Business Aviation Association; Transport Canada.

Strategic Goals:

- Identify and implement opportunities to reduce emissions from APU s and GSE

Milestones:

Over the next five years (2012-2017), the APU / GSE subgroup will meet quarterly in order to:

- Confirm status of emission inventories: who conducted them; how were they developed; what is the contribution from GSE s and APU s;

- Develop baseline of existing equipment: i.e., GSE fleet mix; existing PCA/GPU equipment at gates;

- Identify regulatory framework, policies and procedures for use of equipment;

- Identify current emission reduction initiatives: reviewing what has worked and what has not;

- Identify gaps, barriers and issues that currently prevent optimal use of existing infrastructure;

- Identify initiatives that will lead to resolving these gaps, barriers and issues;

- Research emerging technologies and determine ability to adopt.

Targets and Performance Measurement:

- Specific targets and performance measures will be determined from individual initiatives.

- The subgroup will meet by conference call quarterly and will hold face-to-face meetings on an annual basis.

Initiative management:

The partners mentioned above have agreed to:

- Collect data on inventory of GSE and their fuel burn;

- Collect data on auxiliary power use, use of pre-conditioned air and ground power units; and

- Take inventory of gate infrastructure.

Reporting:

- Responsibility of Report—Subgroup Co-Chairs

Taxi Operations:

Description:

The importance of managing aircraft taxi times increases with the increased number of aircraft ground movements (the busier the airport the more important this initiative becomes). This group will identify opportunities to reduce GHG emissions through improved taxiing and queuing procedures at Canadian airports and reduce overall taxi times. In simple terms, the goal is to limit aircraft main engine run time on the ground.

Partners:

- NAV CANADA; Canadian Airports Council; Air Transport Association of Canada; National Airlines Council of Canada; Transport Canada

Strategic Goals:

- There are five areas targeted:

- Data collection on various elements of airport taxiing and queuing operations;

- Push-back operations;

- Ground crew availability;

- Ground surveillance improvements; and

- Taxi infrastructure improvements.

Milestones/Implementation Considerations:

- All of the initiatives above are underway, as they generally provide improvements to efficiency, safety and reduce fuel costs and

GHGs

. Initiatives 1, 4 and 5 are linked with the Surveillance initiatives of this Action Plan, and are chaired by NAV CANADA.

- Estimated timeframe of outputs

- Short-term (5 years)

- Multilateration (aircraft ground surveillance) installed in Montréal and planned for Calgary and Toronto;

- PARTNER (Partnership for AiR Transportation Noise and Emissions Reduction) computer simulations on airport surface movement optimization may be available within the next five years.

- Medium-Term (5–10 years)

- Identification and addition of new taxiways and runways are an ongoing process.

- Short-term (5 years)

Targets and Performance Measurement

- Airside taxi out times can be reduced by an estimated 20 percent— PARTNER .

- Emission reductions and benefits can be measured against ICAO specified times.

Initiative Management:

The partners mentioned above have agreed to advance:

- Data collection on various elements/segments of airport taxiing and queuing operations;

- Push-back operations;

- Ground Crew availability;

- Ground surveillance improvements; and

- Taxi infrastructure improvements.

Reporting:

- Responsibility of Report—Subgroup Co-Chairs

Alternative Fuels

Description:

To meet the global aspirational goal of carbon neutral growth from 2020, substantial advances in developing and commercializing sustainable alternative aviation fuels will be required. The alternative fuels subgroup will work to identify potential opportunities to advance alternative fuels for aviation in Canada.

Partners:

- National Airlines Council of Canada; Transport Canada; Air Transport Association of Canada; Aerospace Industries Association of Canada; Environment Canada, Natural Resources Canada, National Research Council, Industry Canada, Agriculture Canada, Department of National Defence.

Strategic Goals:

- Identify opportunities to advance alternative fuels for aviation in Canada.

Milestones:

- Survey actions underway on alternative fuels for aviation in Canada, including barriers and opportunities, and propose options for next steps;

- Undertake research on alternative fuels for aviation in Canada and share results with relevant parties;

- Identify opportunities to collaborate with key trading partners, particularly the United States, on alternative aviation fuel research and development and certification, and explore issues such as commercial production;

- Identify the potential for, benefits of, and barriers to alternative aviation fuel production and use in Canada.

Targets and Performance Measurement:

- To be determined

Initiative management:

- NACC and Transport Canada

Reporting:

- Responsibility of Report—Subgroup Co-Chairs

Appendix D—Figures and Tables

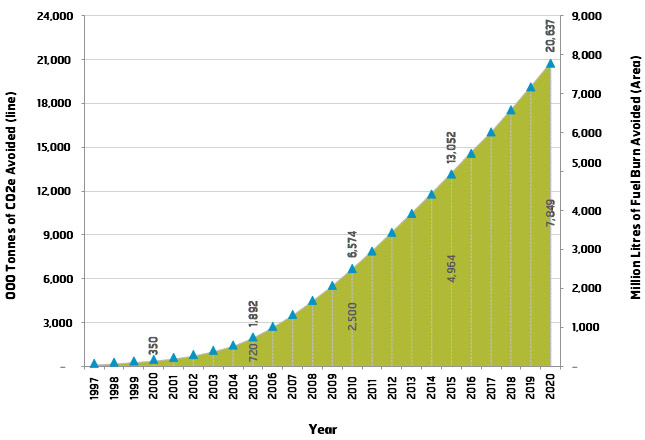

1) Improvement in Canada’s Air Traffic Management

Significant improvements in Canada’s Air Traffic Management system have resulted in fuel savings and avoided emissions. It is estimated that over 20 million cumulative tonnes of carbon dioxide equivalent (CO2e) will be avoided by 2020.

This figure below represents the potential of achievable benefits, and includes all initiatives that have been implemented up to and including 2010. Examples of these initiatives include RVSM, Northern Radar Expansion Program, Polar Routes, ADS-B Hudson Bay, and RNAV/RNP procedures. It does not include any PBN initiatives planned for implementation post-2010 timeframe.

Figure 5—Cumulative Tonnes (000) of CO2 Equivalent and Millions of Litres of Fuel Burn Avoided 1997 - 2020 -- Canadian and International Carriers

Source: NAV CANADA CIFER Report 2012

HTML

| 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 000 Tonnes of CO2e Avoided (Line) | 30 | 62 | 94 | 133 | 186 | 261 | 372 | 511 | 720 | 994 | 1,305 | 1,671 | 2,063 | 2,500 | 2,959 | 3,445 | 3,936 | 4,443 | 4,964 | 5,503 | 6,060 | 6,635 | 7,232 | 7,849 |

| Million Litres of Fuel Burn Avoided (Area) | 80 | 163 | 248 | 350 | 488 | 686 | 977 | 1,343 | 1,892 | 2,615 | 3,432 | 4,393 | 5,425 | 6,574 | 7,780 | 9,059 | 10,348 | 11,680 | 13,052 | 14,469 | 15,932 | 17,446 | 19,013 | 20,637 |

2) Comparisons of Canadian Airlines’ Fleet Age

Canada has a relatively young and modern fleet, with the exception of airlines primarily providing service in the North. For example, the weighted average age of Canada’s three largest airlines (Air Canada, Jazz Aviation LP, and WestJet) is about 12 years.

| Airline | Average Age of Fleet (years) | Number of Aircraft |

|---|---|---|

| Air Canada | 11.8 | 207 |

| Jazz Aviation LP | 15.8 | 139 |

| WestJet | 5.8 | 96 |

| Air Inuit | 28.5 | 27 |

| First Air | 26.7 | 23 |

| Porter Airlines | 2.6 | 26 |

| Air Transat | 16.9 | 18 |

| Sunwing Airlines | 6.0 | 18 |

| Canadian North | 24.3 | 16 |

| Air North Charter | 32.8 | 9 |

| Total Weighted Average Age of Fleet: | 13.4 |

Source: Back Aviation Fleet PC (fleet as of December 14, 2011)

| Airline | Country | Average Age of Fleet (years) |

|---|---|---|

| American Airlines | US | 15.0 |

| Delta Airlines | US | 16.1 |

| Southwest Airlines | US | 11.9 |

| Air France | France | 9.4 |

| Lufthansa | Germany | 13.3 |

| British Airways | United Kingdom | 12.6 |

| Singapore Airlines | Singapore | 7.2 |

| Air China | China | 7.9 |

| Air India | India | 10.2 |

| Japan Airlines | Japan | 8.4 |

Source: Back Aviation Fleet PC (fleet as of December 14, 2011)

3) Aviation’s Impact on the Canadian Economy

Aviation plays a key role in the Canadian economy. The following tables show the value and types of goods shipped by air.

| Sector/ Year | Air Exports* | Air Imports | Air Total | All Modes

Exp. & Imp. |

Air Share (percent) |

|---|---|---|---|---|---|

| Canada/United States | |||||

| 2000 | 23,845 | 23,643 | 47,488 | 588,947 | 8.1 |

| 2001 | 21,875 | 21,114 | 42,989 | 570,040 | 7.5 |

| 2002 | 18,905 | 17,414 | 36,319 | 563,861 | 6.4 |

| 2003 | 17,290 | 15,428 | 32,719 | 530,457 | 6.2 |

| 2004 | 15,688 | 16,254 | 31,942 | 556,545 | 5.7 |

| 2005 | 16,556 | 15,760 | 32,316 | 580,041 | 5.6 |

| 2006 | 14,597 | 15,704 | 30,301 | 575,352 | 5.3 |

| 2007 | 15,559 | 17,571 | 33,129 | 576,510 | 5.7 |

| 2008R | 15,218 | 18,056 | 33,274 | 602,726 | 5.5 |

| 2009R | 13,177 | 16,101 | 29,278 | 456,865 | 6.4 |

| 2010P | 11,870 | 14,915 | 26,785 | 501,385 | 5.3 |

| Other International | |||||

| 2000 | 12,214 | 30,238 | 42,451 | 181,258 | 23.4 |

| 2001 | 12,572 | 27,357 | 39,929 | 177,153 | 22.5 |

| 2002 | 12,488 | 26,406 | 38,894 | 181,473 | 21.4 |

| 2003 | 14,721 | 24,804 | 39,524 | 186,626 | 21.2 |

| 2004 | 18,818 | 28,648 | 47,466 | 209,943 | 22.6 |

| 2005 | 21,524 | 31,755 | 53,279 | 234,518 | 22.7 |

| 2006 | 24,984 | 34,834 | 59,819 | 257,592 | 23.2 |

| 2007 | 25,202 | 38,028 | 63,230 | 280,745 | 22.5 |

| 2008R | 28,180 | 40,015 | 68,194 | 314,761 | 21.7 |

| 2009R | 26,857 | 37,839 | 64,696 | 268,156 | 24.1 |

| 2010P | 26,857 | 42,409 | 73,659 | 299,881 | 24.6 |

| Total Canada/World | |||||

| 2000 | 36,059 | 53,881 | 89,940 | 770,205 | 11.7 |

| 2001 | 34,447 | 48,472 | 82,918 | 747,193 | 11.1 |

| 2002 | 34,447 | 43,820 | 75,213 | 745,334 | 10.1 |

| 2003 | 32,011 | 40,232 | 72,243 | 717,083 | 10.1 |

| 2004 | 34,506 | 44,902 | 79,409 | 766,488 | 10.4 |

| 2005 | 38,079 | 47,515 | 85,595 | 814,559 | 10.5 |

| 2006 | 39,581 | 50,538 | 90,119 | 832,944 | 10.8 |

| 2007 | 40,761 | 55,599 | 96,360 | 857,255 | 11.2 |

| 2008R | 43,398 | 58,071 | 101,469 | 917,487 | 11.1 |

| 2009R | 40,034 | 53,940 | 93,974 | 725,021 | 13.0 |

| 2010P | 43,120 | 57,324 | 100,444 | 801,266 | 12.5 |

Source: Transport Canada, “Transportation in Canada 2010: Addendum – Table A22”, http://www.tc.gc.ca/media/documents/policy/addendum2010.pdf

Notes: R = Revised. P = Preliminary.

1 Total exports include domestic exports and re-exports.

| Exports by air* | 2009R | 2010P | Percent Change |

|---|---|---|---|

| Misc & other manufactured goods | 24,411 | 28,106 | 15.1 |

| aviation-related equipment | 7,574 | 7,423 | -2.0 |

| Machinery & electrical equipment | 11,839 | 11,239 | -5.1 |

| Plastics & chemical products | 2,542 | 2,508 | -1.3 |

| Food products | 537 | 552 | 2.7 |

| Metal & Steel products | 498 | 544 | 9.2 |

| Automobiles & other transport equipment | 82 | 96 | 17.8 |

| Cement & non-metallic products | 38 | 36 | -3.6 |

| Forest products | 36 | 33 | -6.9 |

| LNG & Petroleum products+ | 50 | 3 | -94.4 |

| Minerals, ores & concentrates | 1 | 2 | 105.3 |

| Total Exports by air | 40,034 | 43,120 | 7.7 |

| Imports by air | |||

| Machinery & electrical equipment | 22,362 | 23,732 | 6.1 |

| Misc & other manufactured goods | 20,221 | 22,865 | 13.1 |

| includes aviation-related equipment | 3,770 | 3,362 | -10.8 |

| Plastics & chemical products | 9,511 | 8,769 | -7.8 |

| Metal and Steel products | 962 | 994 | 3.3 |

| Automobiles & other transport equipment | 349 | 395 | 13.2 |

| Food products | 312 | 325 | 4.1 |

| Cement & non-metallic products | 132 | 132 | -0.2 |

| Forest products | 61 | 60 | -1.2 |

| LNG & Petroleum products | 28 | 51 | 85.3 |

| Minerals, ores & concentrates | 1 | 2 | 39.1 |

| Total Imports by air | 53,940 | 57,324 | 6.3 |

Source: Transport Canada, “Transportation in Canada 2010: Addendum – Table A25”, http://www.tc.gc.ca/media/documents/policy/addendum2010.pdf

Notes: R = Revised. P = Preliminary.

1 Total exports include domestic exports and re-exports.

2 LNG = Liquefied natural gas

Footnotes

1 In this context, the aviation industry includes air carriers, air traffic management, airports, and aircraft and other aerospace technology manufacturers.

2 Statistics Canada, Aviation—Civil Aviation, Annual Operating and Financial Statistics, Canadian Air Carriers, Levels I to III, 2009. http://www.statcan.gc.ca/pub/51-004-x/51-004-x2010007-eng.pdf.

3 The United Kingdom Civil Aviation Authority, “UK Airline Statistics: 2009 Annual – Table 1.6 All Services”, http://www.caa.co.uk/docs/80/airline_data/2009Annual/Table_0_1_6_All_Services_2009.pdf.

4 Statistics Canada, “Air Carrier Operations in Canada – Unit Toll Services, Statement 10 (I, II)”, 2009; Statistics Canada”, “Air Carrier Operations in Canada, Charter Services, Statement 12 (I, II, III)” 2009.

5 The United Kingdom Civil Aviation Authority, “UK Airline Statistics: 2009 Annual – Table 1.7.4 Domestic Scheduled Services 2009” http://www.caa.co.uk/docs/80/airline_data/2009Annual/Table_0_1_7_4_Domestic_Scheduled_Services_2009.pdf.

6 Oxford Economics, Economic Benefits from Air Transport in Canada, 2009.

7 Environment Canada, Canada’s Emissions Trends, 2011. http://www.ec.gc.ca/Publications/E197D5E7-1AE3-4A06-B4FC-CB74EAAAA60F%5CCanadasEmissionsTrends.pdf

8 Figure 2 is based on data that allocates emissions to the economic sector in which they are generated rather than by activity. The latter approach is used in Canada's National Inventory Report. As a result, the numbers between the two approaches are not necessarily comparable.

9 The CIFER reports are available at: http://www.navcanada.ca/NavCanada.asp?Language=en&Content=ContentDefinitionFiles\AboutUs\Environment\CIFER\default.xml.

10PBN procedures are more accurate and allow for shorter, more direct routes between two given points, as well as more efficient arrivals and departures. This reduces fuel burn and aircraft emissions.

11 World Economic Forum, The Travel and Tourism Competitiveness Report 2011: Beyond the Downturn, 2011. http://www3.weforum.org/docs/WEF_TravelTourismCompetitiveness_Report_2011.pdf

12 2010 Aviation Industry Report on Greenhouse Gas Emissions Reductions, March 2012. This estimate assumed that the 2001 fuel consumption rate of 0.4651 litres per total Revenue Tonne Kilometres was held constant for each subsequent year until 2010. The resulting emissions were compared against the actual emissions reported for those years to come up with a figure for total emissions displaced over that time period.

13 For example, between 2010 and 2014, Transport Canada has forecasted domestic traffic to grow at a rate of 3.1 percent. In comparison, the October 2010 International Aviation Transport Association ( IATA ) has forecasted domestic growth to occur at a rate of 3.3 percent. For transborder traffic during the same period, Transport Canada forecasts 4.3 percent compared with IATA ’s 3.7 percent.

14 For more information on the National Airlines Council of Canada’s efforts to improve fuel efficiency and reduce GHG emissions, refer to Improving Aviation Efficiency and Reducing emissions: A NACC Framework, 2011. http://www.airlinecouncil.ca/pdf/NACC_FuelEfficiency_Final_Eng.pdf

15Ibid.

16 For more information on the Sustainable Development Technology Canada funds, please visit: http://www.sdtc.ca/index.php?page=about-our-funds&hl=en_CA.

17 Budget 2011 makes an additional $40 M available over two years.

18 For more information on APM , please visit: http://www.navcanada.ca/NavCanada.asp?Language=EN&Content=contentdefinitionfiles\technologysolutions\iatc\default.xml

19 The Working Group is chaired by Transport Canada and consists of one representative of each of the other member organizations.